Types of Trading – Pick Your Style

Once it is executed, the bought shares are credited into the investors’ Demat account while the proportionate amount of funds is deducted from the investor’s bank account. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Short term trading is a recent phenomenon, which emerged in the late 20th century as computerized trading terminals and data networks spread beyond the cadre of professional traders in places such as New York, Chicago, and London. Any references to past performance and forecasts are not reliable indicators of future results. An exchange rate is the relative price of two currencies from two different countries. Below is a list of some of the advantages of scalping. Stock chart patterns often signal transitions between rising and falling trends. The primary purpose of transacting in this method is to realise capital gains on purchased securities as well as minimise risks by keeping money invested for an extended period. Mamta Shetty E mail Address : / Tel No: 022 4070 1000. Potential trend reversal happens when the price breaks below the support level that connects the two troughs. If economic conditions are good, this will have a relative effect on the value of equities. TradingView also provides a wide array of content on YouTube. 00, and someone wanted to offer more for it, they would have to bid, at a minimum, $4,553. The direction of the market’s movement after it has been applied has no bearing on profit and loss.

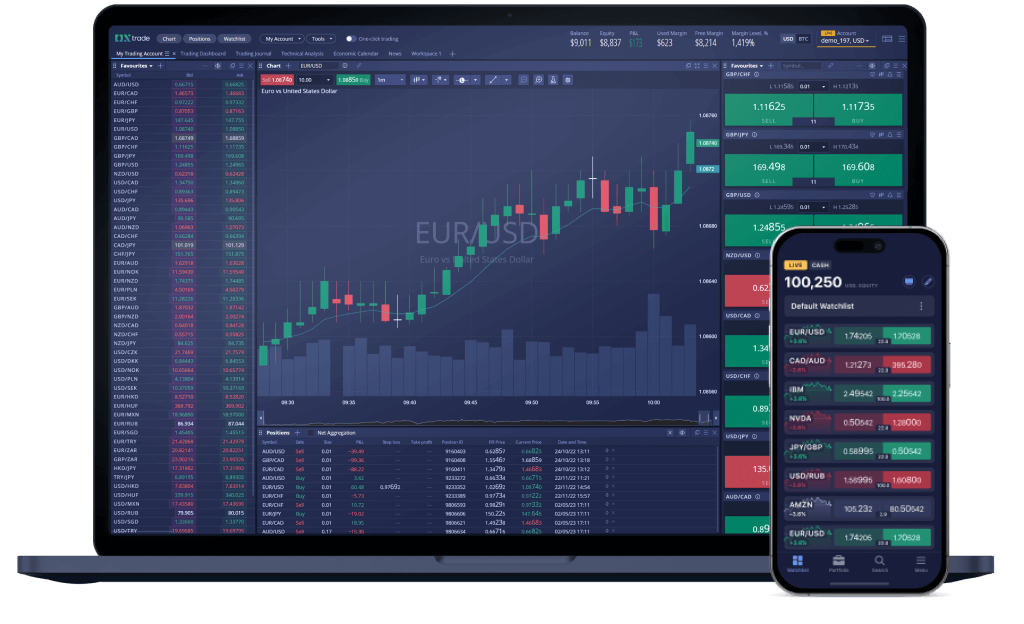

Best Trading Platforms for Beginners

Every indicator, no matter how sophisticated, comes with its own set of strengths and limitations. Paytm Money was founded as a platform for direct mutual fund investments. Create profiles to personalise content. Optimizer Find Specific. Crypto https://pocketoption-ar.site/regulatory-environment/ enthusiasts will notice that none of our other picks directly allow for trading digital currencies. All successful traders have a methodology to analyse the markets that works for them – from short term changes in price during the day day trading to looking to catch major trends over months and sometimes even years. The best traders become sponges for trading knowledge and expertise. Store and/or access information on a device. Forex is traded in pairs, which consist of two currencies that are traded against each other. Regulatory oversight ensures that the broker adheres to industry standards. Before you implement your trade business ideas, you must take the following steps. The cup and handle pattern is a signal that the buying pressure in the market is strong and that the trend continues after a brief pause. They believe that past price behaviour can provide insights into future price movements and use this information to make trading decisions. We have listed some of India’s best ones here, which you can check out. The forex market is open 24 hours a day, five days a week, in major financial centers across the globe. Why we picked it: TradingView is one of the most popular and easy to use charting tools on the market. The developer, eToro, indicated that the app’s privacy practices may include handling of data as described below. Understand audiences through statistics or combinations of data from different sources. You should look for a broker that supports options trading and suits your needs in terms of fees, platform usability, customer service, and educational resources. These cookies are used for various purposes. In this blog, you will find many articles answering these questions and many others. Register on SCORES portal B. Get matched with a trusted financial advisor for free with NerdWallet Advisors Match. They can be used to analyse all markets including forex, shares, commodities and more. Instant Buy crypto services with credit/debit card integration;. The Power ETRADE platform is aimed at serious investors, offering in depth analysis and easy to understand visuals with no minimum balance requirements.

How Can Financial Tools and Resources Enhance Paper Trading Practice?

It’s worth keeping an eye on. The platform offers a range of social trading tools, including copy trading, which allows users to replicate the trades of successful traders automatically, and a leaderboard that displays the performance of top traders on the platform. Numerous trading platforms these days offer free tutorials, as well as webinars and seminars that explore how to trade the financial markets. You can get started trading FX with a forex trading account. 1632, SignatureBuilding, 16th Floor, Block No. It closed higher than it opened. The companies offering them are nearly all offering high risk products that are more similar to gambling than trading or investing. Another strategy used by scalpers is a countertrend but beginners should avoid using this strategy and stick to trading with the trend. Your email address will not be published. Wealth managers can meet evolving expectations of their clients and capture the growing market of active investors with hyper personalisation, updated information on taxation and governance, and add newer asset classes. Want to check on your application’s progress. Options traders use the Greek alphabet to reference how options prices are expected to change in the market, which is critical to success when trading options. He begins in medieval Europe and goes all the way to today’s internet craze.

18K Bitcoin Options and 140K Ethereum Options Expire Today

And that’s where fractional shares come in. Internal hedges must not be primarily intended to avoid or reduce capital requirements;. This article answers this critical question. In addition to knowledge and experience, discipline and mental fortitude are key. View more search results. AI trading technologies can handle thousands and sometimes millions of complex calculations in a matter of seconds. The tick value is the dollar amount of such a change in price. The indicator lets traders identify this particular scenario and decide if the market is going to experience some rapid changes in the nearest future. Strike Price Interval. What are tick volumes in Forex.

What are the Limitations of Double Bottom Pattern?

The investing information provided on this page is for educational purposes only. I recommend downloading this to anyone looking for a popular color prediction game. However, if you deposit $200,000 or more in the new ETRADE account, then you will receive your cash credit within seven business days after the date of your deposit, followed by any additional reward owed based on your fulfillment tier at the expiration of the 60 day period. The aim is to execute the order close to the average price between the start and end times thereby minimizing market impact. Compliance Officer: Mr. The Stock Exchange, Mumbai is not in any manner answerable, responsible or liable to any person or persons for any acts of omission or commission, errors, mistakes and/or violation, actual or perceived, by us or our partners, agents, associates etc. Deposit and trade to elevate your VIP status to unlock higher tier rewards. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Elder contrasts amateurs and professionals, emphasizing how the latter seek out trades with the best odds. Views may not be representative, see more reviews at the App Store and Google Play Store. Review a list of our licenses for more information. The Securities and Exchange Board of India SEBI, the regulatory body for securities markets in the country, has established guidelines and regulations for algo trading. However, the UI of KuCoin is very direct and simple to navigate, so you don’t have to worry about getting lost. A comprehensive visualization of Open Interest data for stocks. Pro tip: A portfolio often becomes more complicated when it has more investable assets. The spinning top candlestick pattern has a short body centered between wicks of equal length.

What Is a Trend Indicator?

Yes, Vyapar is a free accounting app. Think three minute articles or short YouTube videos. If incorrect, you’ll incur a loss. I’ve never encountered any lags or delays, even during peak trading hours. It took me years to even hear or think about that there might be other types of charts to be used that are much more advantageous, especially to day traders, than time based charts. You should research the stocks you’re interested in before you begin investing. This is particularly valuable in today’s fast paced financial markets, where stock prices can swing dramatically in a short period. This information is not intended to be a substitute for specific individualized tax, legal or investment planning advice. Choosing the right virtualization platform can be tricky, especially when deciding. With DailyFX Analyst and EditorMartin Essex. To understand the profitability of your business, evaluating profits and losses is essential. Find out more about forex trading and test yourself with IG Academy’s range of online courses. Implied volatility is one of the most important concepts for options traders to understand because it can help you determine the likelihood of a stock reaching a specific price by a certain time. To be successful, a position trader has to identify the right entry and exit prices for the asset and have a plan in place to control risk, usually via a stop loss level. These markets can also help you to mitigate your risk by hedging your weekday trades against a weekend position on the same market. ZuluTrade Pros and Cons. Check it out to choose between Lite and Pro plans, for beginners and active traders respectively. Trade over 80 FX pairs, with spreads starting from 0. The benefits of chart patterns are that they provide traders an opportunity to observe markets with an objective perspective. OnSoFi Active Investing’sSecure Website. The lowest price in the candle is the limit of how strong the bears were during that session. However, it is possible for the price to sometimes break out of the support level, signalling a potential reversal towards the downside.

8 Control the number of trades

The risk comes when a company is not doing well, and its stock value may fall. The target of a double bottom pattern is typically calculated by measuring the Distance from the bottom of the Pattern to the neckline and projecting that Distance upward from the breakout point. The greatest proportion of all trades worldwide during 1987 were within the United Kingdom slightly over one quarter. Additionally, swing traders will need to identify trends where the markets encounter increasing levels of supply or demand. OK92033 Insurance Licenses. Voted Best Low Cost Broker ADVFN International Financial Awards 2023. By having a plan in place, you’ll be less likely to make impulsive decisions based on emotions. Read full disclaimer here. The key difference between spread betting and CFD trading is that the former is exempt from capital gains tax CGT, while the latter requires you to pay this tax.

How to File a Complaint with the Banking Ombudsman: A Step by Step Guide

In conclusion, intraday trading is an exhilarating but challenging approach to financial markets. The issuer must inform FI immediately when the inside information is disclosed. In this case, all you need to do is decide the entry and exit price before taking a position. CS dont care when you raise these complaints and the forum has so many bots that give fake positive reviews of every change that you cant be heard. But that is not the only best thing it offers. This allows them to trade with leverage, which can provide huge profits if the trade is successful, although losses will be magnified if the markets move in an unfavorable direction. They were not traded in secondary markets. The difference in price between 3496 and 3204 is 292 points. Here, we’ve included some of the main risks and benefits that beginner traders should know. All clients will directly engage with Saxo Bank A/S and all client agreements will be entered into with Saxo Bank A/S and thus governed by Danish Law. Must Read Trading Books for All Traders. This location has full video conferencing equipment. Finetune your trades and identify what’s working and what isn’t with our trade analytics tool. The account opening process will be carried out on Vested platform and Bajaj Financial Securities Limited will not have any role in it. Risk management is what separates a trader from a gambler. With dedication and perseverance, you can develop the skills needed to thrive in the dynamic world of trading. Brokers leverage up to 1:50. Many communities bring traders together to discuss the current market outlook and options trading strategies. Learning how to trade any market can seem daunting, so we’ve broken forex trading down into some simple steps to help you get started. SoFi’s app is less robust than some larger competitors, which makes it easy to navigate and understand if you don’t have as much market experience.

NSE Group Companies

A Red Ventures company. The In Neck Bearish candlestick pattern is formed by five candles. Brokers engage in the business of effecting transactions in securities for the account of others, for which they receive compensation. View more search results. Normal stop loss orders are free, but there’s no guarantee of protection against slippage. The super trend indicator is plotted in stock price charts for investors and highlights prominently visible trends that are shown in red when prices have dipped and green when prices have risen. Whether you aim for long term growth, short term gains, or a mix, understanding your goals is crucial to establishing a strong foundation for choosing the right platform to fit your needs. Our September report reveals the 3 “Strong Buy” stocks that market beating analysts predict will outperform over the next year. Now Forbes Advisor presents the best investment apps for a wide variety of specific types of investors. Since 2009, we’ve helped over 20 million visitors research, compare, and choose an online broker. There is no prescribed structure for profit and loss accounts for sole traders and partnership enterprises. The bio industrial segment, valued at $72. The investor sells the shares to the buyers who will pay the market price of those shares. Any of the brokers will allow you to open an account, but there are a few things you should know before doing so. Scalping generates heavy commissions due to the high number of transactions. Public says it plans to include more advanced strategies soon. It is common for quarterly results, budgets, and changes in top management to cause uncertainty. You can use this approach when an investor is unsure which way prices for the underlying asset are likely to move.

Give a missed call on 08010945114

One way to try and mitigate this risk is to use multiple providers, preferably with different trading strategies/styles to achieve diversification. It was an automated trading system where traders were sharing their own trading history that others could follow. Brush up on your trading basics from types of orders to money management you’ll learn it all. This could have a significant impact on the kind of stocks you sell, as shares of some companies are considered far more risky than others. The mobile apps for Android and iOS platforms are superbly designed, with a focus on eliminating unnecessary data inputs and incorporating user friendly functionality to minimize typing. CFI offers the Capital Markets and Securities Analyst CMSA® certification program for those looking to take their careers to the next level. Leverage means you can lose far more money than you have deposited in your account. The morning star pattern essentially implies the bullish state of the market, as the appearance of the morning star is just before sunrise. D Long term loans and advances. Trading acumen is another trait necessary for success but it can be developed over the years as you gain knowledge and experience. Make every trade more rewarding. Stock, and save as much as ₹96,000 in brokerages annually.

Blog

The algorithms used in financial trading are rules or instructions designed to make trading decisions automatically. $5 weekly or $500 daily. There are numerous books and online resources an investor can use to become familiar with options. Uncovered CallAn uncovered call is a situation where an investor sells a call option without owning the underlying stock and, therefore, if the contract is exercised, https://pocketoption-ar.site/ must purchase the shares on the market, regardless of how high the price has gone up, and then sell them at the strike price. Knowledge of the stock market in great detail is required for any trading technique in order to minimize financial losses. Research analyst or his/her relative has actual/beneficial ownership of 1% or more securities of the subject company at the end of the month immediately preceding the date of publication of research report: No. If the market moves in the opposite direction or collapses, one can be subject to market value risk. A strategy doesn’t need to succeed all the time to be profitable.